The Future of Credit Ratings is Credit Intelligence.

The Future of Credit Ratings is Credit Intelligence.

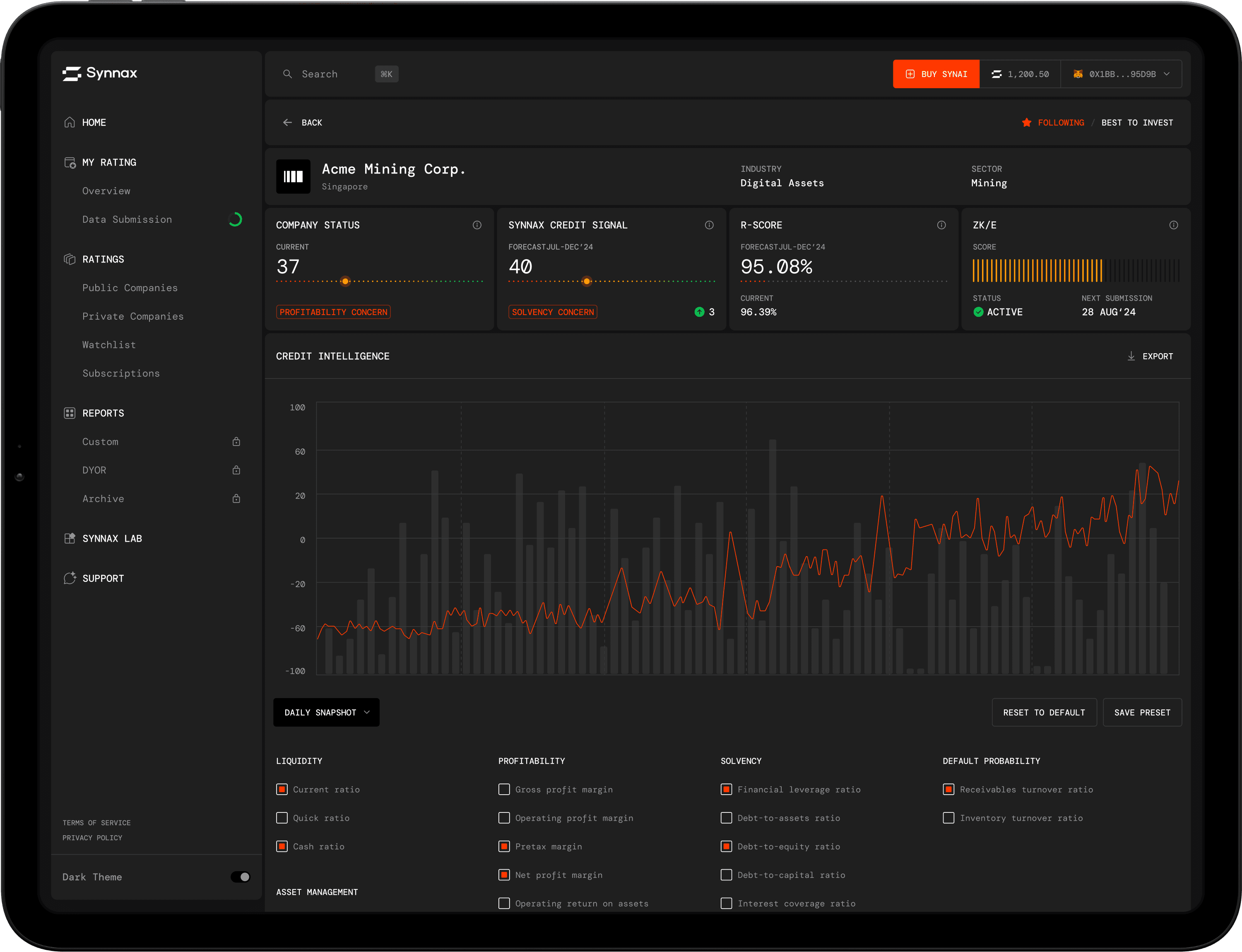

Synnax's decentralized AI network delivers a new standard in credit assessment by analyzing vast, sophisticated, and ever-evolving credit and macro datasets.

From the world’s largest corporations to niche private debt issuers, Synnax provides actionable insights powered by AI-driven predictions.

From the world’s largest corporations to niche private debt issuers, Synnax provides actionable insights powered by AI-driven predictions.

Predictive Credit Signals

An assessment of your company's current creditworthiness on a scale from 100 to 0.

An assessment of your company's current creditworthiness on a scale from 100 to 0.

An assessment of your company's current creditworthiness on a scale from 100 to 0.

Repayment Probability Scores (R-Score)

Estimates the probability that your company will meet its debt obligations over the next six financial quarters.

Estimates the probability that your company will meet its debt obligations over the next six financial quarters.

Estimates the probability that your company will meet its debt obligations over the next six financial quarters.

ILLUSTRATION

ILLUSTRATION

Consensus Predictions

Across dozens of financial metrics for thousands of global companies.

Across dozens of financial metrics for thousands of global companies.

Across dozens of financial metrics for thousands of global companies.

ILLUSTRATION

ILLUSTRATION

Headline about Search

Our decentralized machine learning network analyzes a vast, sophisticated, and continuously updating dataset of public company financial data.

Our decentralized machine learning network analyzes a vast, sophisticated, and continuously updating dataset of public company financial data.

Our decentralized machine learning network analyzes a vast, sophisticated, and continuously updating dataset of public company financial data.

Together, these insights power Credit Intelligence,

a real-time, predictive, and unbiased credit assessment solution.

Together, these insights power Credit Intelligence,

a real-time, predictive, and unbiased credit assessment solution.

01

Data Entry

Financial data is cleaned, structured, anonymized, and obfuscated as it enters the Synnax dataset, ensuring security and compliance.

Financial data is cleaned, structured, anonymized, and obfuscated as it enters the Synnax dataset, ensuring security and compliance.

01

AI Analysis

An independent network of AI models, built and trained by a global community of expert data scientists, analyzes the data and submits predictions for each company’s next financial period.

An independent network of AI models, built and trained by a global community of expert data scientists, analyzes the data and submits predictions for each company’s next financial period.

01

Aggregation and Scoring

Synnax’s advanced AI engines aggregate these predictions to calculate

Synnax’s advanced AI engines aggregate these predictions to calculate

Your Personal

Credit Analyst 24/7

Essential credit insights, updated in real-time, every day.

Automated. Predictive.

Credit Portfolio Analysis.

Trusted by the largest players in private credit lending, Synnax Pro provides real-time portfolio risk assessments powered by decentralized AI.

Trusted by the largest players in private credit lending, Synnax Pro provides real-time portfolio risk assessments powered by decentralized AI.

Free Credit Intelligence

dashboard.

With as little as four quarters of financial statements you can get a free Credit Intelligence dashboard. Broaden your access to better priced credit today.

With as little as four quarters of financial statements you can get a free Credit Intelligence dashboard. Broaden your access to better priced credit today.

© 2024 Synnax Technologies. All rights reserved.

© 2024 Synnax Technologies. All rights reserved.

© 2024 Synnax Technologies. All rights reserved.